Capitalize on the increasing demand and prices of carbon credits

The Green Carbon Fund is a carbon credit fund that provides investors exclusive access to high-value carbon projects, a market typically reserved only for major corporations.

TARGETED RETURNS

FUND LIFETIME

PROJECTED ANNUAL CASH FLOW

*Investment involves risk. Projected returns are not guaranteed, and actual results may vary. The double-digit returns are over the fund's term and include projected annual distributions of 8%, paid quarterly.

HOW IT WORKS

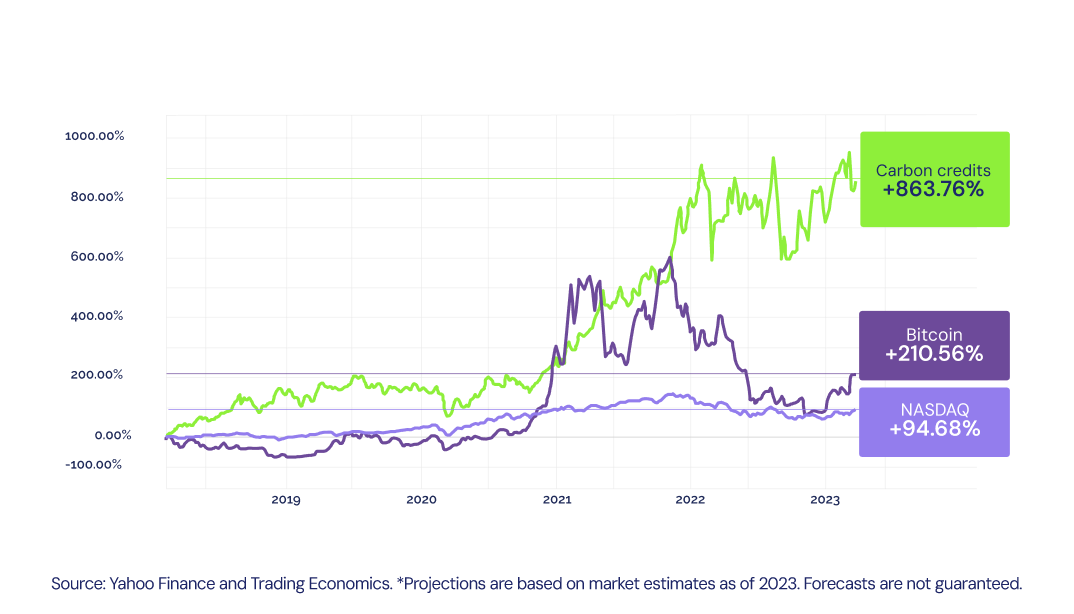

Carbon credits are the fastest growing commodity

Global net-zero targets in line with the Paris Agreement are increasing the demand and prices of carbon credits, especially for high-quality credits from nature-based solutions — making carbon credits an increasingly valuable asset for investors.

But they are not accessible for ordinary investors

Limited access

Buying, trading, and selling carbon credits often remain realms dominated by large corporations. Most leading carbon registries don’t allow private individual account holders.

Transaction scale

The carbon credit market is dominated by large-scale transactions, typically by big corporations that buy bulk offsets—which is often out of reach for smaller investors.

Market access

Major players in the industry often enjoy exclusive access to primary markets and early-stage carbon projects, a privilege typically out of reach for smaller players.

High entry cost

Investing in carbon credits often demands significant upfront capital, particularly for high-quality credits, making it challenging for regular investors to participate.

Regulatory hurdles

The carbon market is heavily regulated, with varying rules across regions, requiring specialized knowledge that most average investors do not possess.

Project access

Many high-quality carbon projects are linked to private deals or specialized funds, making them difficult for average investors to identify and access.

The Green Carbon Fund lets investors tap into the carbon credit market, blending environmental impact with strong financial returns

WHAT WE OFFER?

Our strategic approach to sustainable carbon investment

Our approach is meticulously designed and strategically executed. Our carbon credit fund invests in large-scale carbon projects, a process that involves rigorous due diligence and careful best-in-class selection. This comprehensive process not only enables us to generate returns through nature-based investments but also contributes to environmental sustainability, striking a balance between financial growth and responsible investing.

Brands that use carbon credits

Starbucks, the global coffeehouse chain, is harnessing its significant resources to invest in carbon credits, demonstrating a commitment to eco-friendly business practices and continued market success.

.webp?width=80&height=80&name=General-Motors-GM-Logo%201%20(1).webp)

General Motors is implementing a holistic approach to become carbon neutral by 2024, which includes the use of carbon credits. For vehicle emissions from 2012–2018 alone, it retired 50 million carbon credits.

Google is committing $35 million to carbon credits, significantly integrating its economic goals with environmental responsibility. This investment positions Google as a leader in corporate environmental strategy.

ABOUT US

Why invest with us?

VanderStyn is an innovative carbon credit investment firm that focuses on funding large-scale, high-quality, nature-based solutions. Our mission is to create a greener future by leveraging the power of finance to drive significant environmental change.

The carbon credit marketplace is projected to grow up to $50 billion by 2030, and our carbon credit fund lets you benefit from this growth.

Tap into the carbon credit market — a promising long-term investment opportunity set for ten-fold growth by 2030

Merging financial growth and sustainability is essential

The world is facing significant environmental challenges. Issues such as rampant deforestation, escalating pollution levels, and the rapid loss of biodiversity pose serious threats to our ecosystems. These challenges necessitate immediate and innovative solutions that go beyond conventional approaches to environmental conservation.

Conventional investment strategies frequently neglect environmental implications, prioritizing returns without accounting for the potential ecological impact of their ventures. This short-sighted approach is increasingly untenable in a world where sustainability is paramount.

The Green Carbon Fund is leading a paradigm shift, offering carbon credit investment solutions that seamlessly blend financial growth with ecological responsibility and social progress.

01.

Why nature-based solutions?

Nature-based solutions is the most scalable method to effectively mitigate carbon emissions while restoring ecosystems. It can provide 37% of the CO2 mitigation needed to meet the Paris Agreement’s targets by 2030. In addition to carbon mitigation, nature-based solutions offer many benefits such as biodiversity enhancement, habitat restoration, and sustainable community development.

02.

Our approach

Our carbon credit investment approach is meticulously designed and strategically executed. We invest in large-scale, nature-based projects, a process that involves rigorous due diligence and careful best-in-class selection. This comprehensive process enables us to generate returns and contributes to environmental sustainability, striking a balance between financial growth and responsible investing.

03.

Beyond personal gain

By choosing to invest in our carbon credit fund, you're not merely fortifying your financial future, but also actively participating in the stewardship of our planet. Your investment goes beyond personal gain, it becomes a powerful tool in fostering a greener, more sustainable world. Our portfolio of projects has verified benefits, ensuring their long-term impact on the environment and local communities.

Stay up to date with our latest content

Subscribe to our newsletter

Join the VanderStyn newsletter to get fresh

updates on time.