The carbon market will keep growing

The global carbon compensation market was estimated at $4 billion in 2023 and is expected to grow almost 40% from 2024 to 2030. This market is driven by the rising demand for carbon credits to address carbon footprints, increasing carbon credit prices.

How do we do it?

The valuation at each stage of a project is the core of how we invest in the carbon market. It supersedes the previous stage's valuation, reflecting the increasing value of the carbon credit project as it progresses.

STAGE 01.

Early-stage (cost) valuation

At the time of initial investment, the Fund purchases carbon credits before they are issued, at a predetermined price reflecting the early stage and high risk of the project. These credits are valued at the cost paid per unit since the project has not yet reached any developmental milestones that would mitigate risks and increase value.

STAGE 02.

Value at validation

Validation indicates that the project's methodology and potential emissions reductions have been preliminarily approved by a third-party audit firm and accepted by a leading carbon registry. This stage reduces the project risk as it moves closer to fruition, justifying an increase in the valuation of the investment.

STAGE 03.

Valuation at verification

Verification (or issuance) is achieved when the project has been audited, and the actual emissions reductions have been verified, warranting the issuance of carbon credits. This milestone significantly reduces the risk as the credits now represent verified emissions reductions and are ready for trading.

Worldwide mega trend

Since 2015, 196 countries have committed to environmental action and are actively working on solutions to reduce global emissions and become more sustainable.

Companies worldwide have also joined this movement.

How is this done?

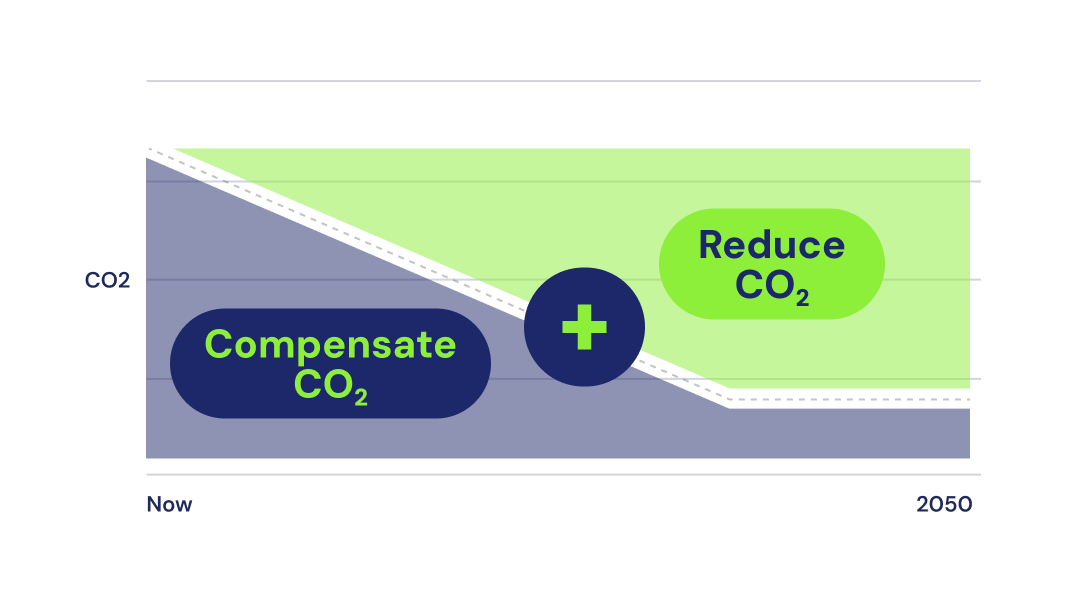

To become more sustainable and align with the global shift towards a low-carbon economy, companies have to address their carbon footprints.

This means implementing carbon reduction and compensation measures. Carbon reduction entails reducing emissions that can be reduced — but this takes time. How do companies address hard-to-abate emissions now?

To address these hard-to-abate emissions, leading companies worldwide are compensating for their irreducible emissions with carbon credits.

All multinationals compensate for their emissions

The world's largest companies, collectively responsible for 7.2 billion tonnes of annual CO₂ emissions, already have validated emissions reduction targets. Due to legislation and regulations, they must report on their emissions and how they are addressing their carbon footprints. They do this through emissions reduction and compensation. And VanderStyn targets these buyers.

Carbon footprint reporting is done by all companies with sustainability goals, and 75% of all multinationals report on their environmental impact.

.png?width=1112&height=840&name=Frame%2021%20(1).png)

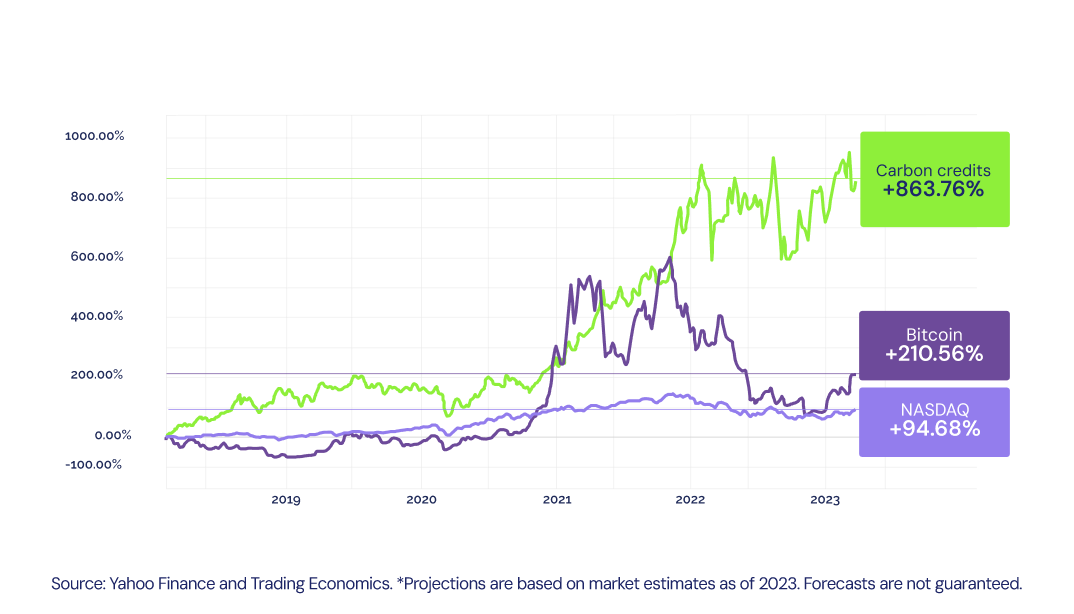

Carbon credits are the fastest growing commodity

The rising demand for carbon credits, particularly high-quality credits from nature-based solutions, is outpacing supply, causing a shortage of credits and driving up prices. Projections indicate that the voluntary carbon credit market could reach a staggering value of $1 trillion by 2037. For investors, this represents a prime opportunity to capitalize on the growing carbon credit market and invest in high-integrity carbon credits, which are becoming an increasingly valuable asset.

OUR EXPERTS

Our strategic approach to sustainable carbon investment

The Green Carbon Fund employs a straightforward and effective strategy: We only invest in high-quality projects, and we buy low and sell high, ensuring robust returns. Returns are generated through nature-based investments.

We invest in carbon projects at their earliest stages, securing significant discounts as these projects mature. This patience pays off as larger corporations prefer to purchase established issued credits on the market.

Our expert hands-on team is actively involved in designing and implementing these projects throughout their lifetime, ensuring high-quality credits. We leverage our established network of Fortune 500 companies, the biggest buyers in this market, to maximize returns. When it's time to sell, we auction the credits to these major corporations, ensuring premium prices.

Benefits of investing in carbon credits

Market growth

The carbon credit market is expected to grow and could reach $50 billion by 2030, up from $300 million in 2018.

Regulatory support

Global regulations like the EU’s Fit for 55 package to reduce GHG emissions drive demand for carbon credits.

High potential returns

Tightening regulations is likely to boost demand and carbon credit value, offering early investors high returns.

Diversification

Carbon credits reduce portfolio risk, showing a low correlation with traditional assets and providing stability.

Social & environmental impact

Investing supports emission reduction projects, aiding climate action and biodiversity.

Incentive mechanisms

Some jurisdictions offer tax incentives for carbon offsets, lowering investment costs and fulfilling regulatory requirements.

Why early-stage pre-purchase agreements are the top choice to invest in carbon credits

REASON 01.

Price stability

Pre-purchase agreements lock in prices for carbon credits at an early stage, providing price stability and predictability for investors. This helps mitigate the risk of price volatility.

REASON 02.

Cost efficiency

Investing through pre-purchase agreements often allows investors to buy credits at a lower cost before the projects reach maturity and their full value. This cost efficiency is crucial in maximizing the return on investment.

REASON 03.

Market influence

Investors who engage in pre-purchase agreements can have more influence over project selection and management. This can help steer projects towards higher standards of environmental integrity and innovation.

REASON 04.

Project support

These agreements provide essential upfront funding for developing carbon reduction projects, particularly those in developing regions or innovative technologies. This helps combat climate change and support sustainable development goals.