Carbon markets and their growing impact explained

Carbon markets have become essential in the global effort to reduce emissions by creating financial incentives for sustainable practices. This article explores how carbon markets operate, their different types, and the wide-ranging benefits they offer for both businesses and the environment.

What are carbon markets?

As the world faces increasing environmental instability, the need for solutions to manage carbon emissions has never been more important. Carbon markets are emerging as one of the most effective tools in addressing this challenge, offering a structured way to reduce global emissions. In this article, we’ll differentiate between compliance and voluntary carbon markets, explore their benefits, and explain how they support sustainability goals.

Carbon markets are systems where companies or organizations can buy and sell carbon credits to offset their greenhouse gas emissions. These markets are designed to incentivize emissions reductions by putting a price on carbon. There are two main types of carbon markets: compliance markets, where companies must adhere to government-imposed emission caps, and voluntary markets, where companies and individuals can purchase credits to meet self-imposed sustainability goals. In both cases, entities that reduce their emissions below a set threshold can sell their surplus credits to those that exceed their limits, driving collective progress toward lower emissions.

Close-up of tree seedlings in a tree nursery. AI generated picture.

Close-up of tree seedlings in a tree nursery. AI generated picture.

Understanding the importance of carbon markets

Carbon markets have become a vital tool in the global effort to mitigate the effects of increasing emissions. They provide financial incentives for businesses and governments to lower their carbon footprint, fostering a low-carbon economy. With the global carbon market valued at over $909 billion and projected to grow significantly, it's clear that these markets are only becoming more relevant.

Not only do they create a framework for lowering emissions, but they also encourage innovation in sustainable technologies and energy efficiency. As the need to address environmental conditions intensifies, carbon markets have emerged as an essential mechanism in reducing the world's carbon output.

Discover more: The rise of carbon markets: a new frontier in sustainable investing

Compliance carbon markets: the regulatory framework

Compliance carbon markets are regulated systems where governments or international bodies set a cap on the amount of carbon emissions that entities within a certain sector (like power generation or manufacturing) can emit. If an organization exceeds its allowance, it must purchase carbon credits or face penalties. Entities that emit less than their allotted amount can sell their excess capacity to those that exceed their limits, thereby promoting emissions reductions across the board. These markets are crucial in helping countries meet their legally binding emissions reduction targets.

These carbon markets play a critical role in reducing emissions and encouraging the development of low-carbon technologies through emissions trading systems and cap-and-trade programs.

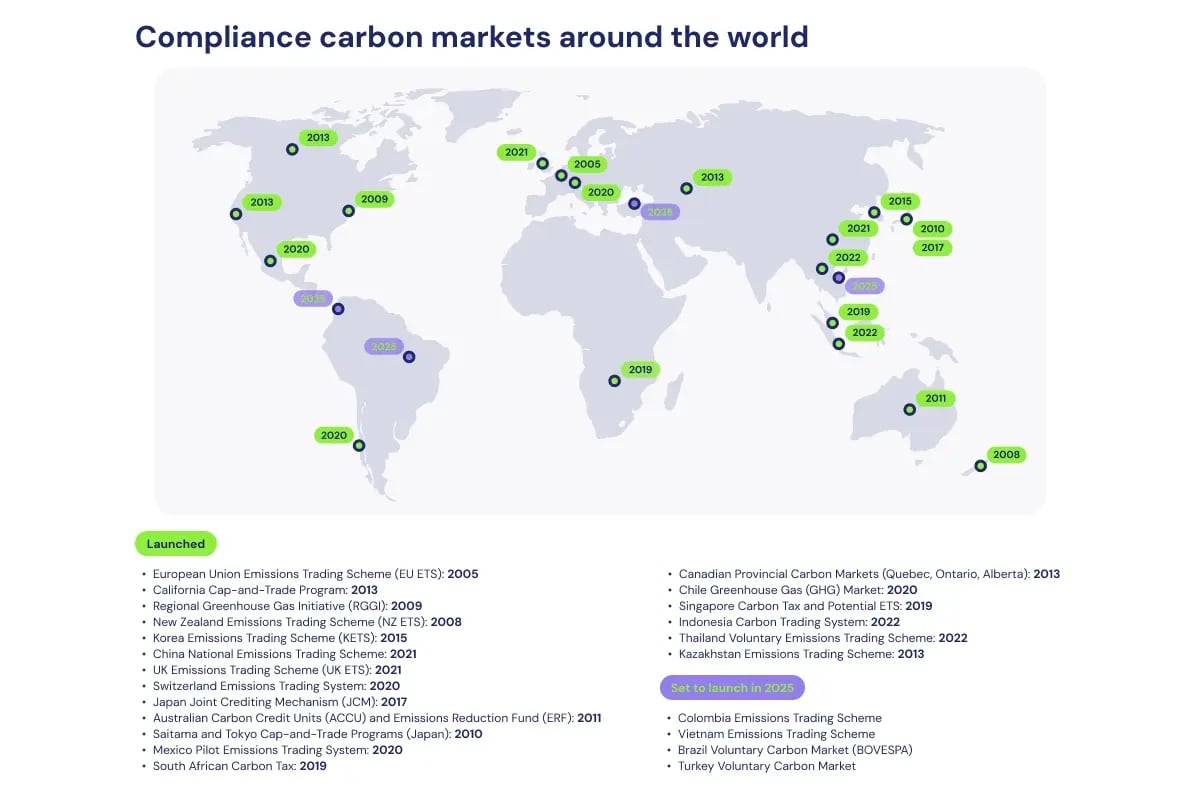

As seen in the graphic, compliance carbon markets are widespread around the world. The most prominent of these markets are the following:

- European Union Emissions Trading Scheme (EU ETS): The world’s largest carbon market, covering power plants, industrial factories, and airlines within Europe.

- California Cap-and-Trade Program: One of the largest markets in the U.S., covering power generation and industrial sectors.

- Regional Greenhouse Gas Initiative (RGGI): A market covering 12 states in the Northeastern U.S., primarily targeting emissions from power plants.

- China’s National Carbon Market: The world’s biggest carbon market in terms of emissions volume, initially focused on the power sector.

- Korea Emissions Trading Scheme (K-ETS): The first nationwide carbon market in East Asia, covering key industrial sectors.

Benefits of compliance markets

Compliance markets provide a structured, enforceable way to reduce emissions, helping governments meet their environmental targets and offering several key benefits:

- Regulatory compliance: The primary purpose of compliance carbon markets is to help companies and industries meet legally mandated emissions reduction targets, ensuring they stay within government-enforced limits on carbon emissions.

- Economic incentives for emission reductions: By setting a cap on emissions and allowing companies to trade carbon credits, compliance markets create financial incentives for companies to invest in cleaner technologies and reduce their carbon output. Companies that lower their emissions can sell their surplus credits, encouraging innovation and efficiency.

- Certainty of environmental impact: Because compliance carbon markets are highly regulated, they ensure that emissions reductions are real, measurable, and permanent. This creates a more reliable system for achieving significant and sustained environmental impact.

- Market stability: Compliance markets operate under strict regulatory frameworks, which provide stability and predictability. The government-set caps and oversight help to create more consistent pricing and avoid excessive market fluctuations.

- Scalability: Compliance markets operate on large scales and cover entire sectors or regions. This allows for significant emissions reductions across major industries and ensures that large polluters are held accountable.

- Global cooperation: Compliance markets, especially those that allow for international emissions trading (as supported by Article 6 of the Paris Agreement), promote global cooperation in reducing carbon emissions. Countries and corporations can work together to meet their emissions goals through a shared system.

- Encourages technological innovation: By creating a cost for emissions, compliance markets push companies to develop and adopt new technologies and processes to reduce their carbon footprint, accelerating the shift toward a low-carbon economy.

- Supports government revenue: In some compliance markets, governments can auction off emissions permits, generating revenue that can be reinvested into clean energy projects or other sustainability initiatives.

Jaguar in its natural habitat, the Amazon tropical rainforest. AI generated picture.

Jaguar in its natural habitat, the Amazon tropical rainforest. AI generated picture.How government policies drive demand

Government regulations are a major force driving demand in compliance markets. As more countries strengthen their environmental laws and set stricter emissions limits, companies are compelled to participate in carbon markets to meet regulatory requirements. This regulatory framework is essential to ensuring that emissions reductions occur at the pace necessary to meet international targets.

Discover more: Why carbon credit prices will rise?

Voluntary carbon markets: corporate and individual participation

Voluntary (or verified) carbon markets operate outside government mandates, allowing corporations, organizations, and individuals to offset their carbon emissions voluntarily. These markets are typically used by businesses with strong Environmental, Social, and Governance (ESG) commitments, aiming to demonstrate leadership in sustainability.

Participants in voluntary markets range from global corporations like Apple and Microsoft, which commit to becoming carbon neutral, to individuals looking to reduce their carbon footprint. These entities purchase verified carbon credits from projects that reduce or remove carbon from the atmosphere, such as reforestation or renewable energy initiatives.

In a partnership with Conservation International, Apple is restoring degraded savannas in the Chyulu Hills region of Kenya. Source: Apple

In a partnership with Conservation International, Apple is restoring degraded savannas in the Chyulu Hills region of Kenya. Source: Apple

As consumer demand for sustainable products grows, businesses are under increasing pressure to align their operations with environmentally conscious practices. Voluntary carbon markets offer companies a way to meet these expectations by compensating for their emissions. Furthermore, once a company commits to a voluntary goal and communicates it to investors, it often becomes an obligation, as shareholders demand accountability. These ‘voluntary’ targets are therefore a big driver for companies to address their carbon footprints and purchase carbon credits.

Discover more: 3 Growth trends for the voluntary carbon market in 2025

Benefits of the voluntary carbon market

The voluntary carbon market offers several benefits:

- Flexibility and accessibility: Unlike compliance markets, the voluntary carbon market allows companies, individuals, and organizations to compensate for their emissions without being mandated by regulation, giving them the flexibility to contribute to sustainability on their own terms.

- Corporate responsibility and branding: Companies can enhance their reputation by showing leadership in sustainability, responding to consumer demand for environmentally responsible practices, and demonstrating their commitment to reducing their carbon footprint.

- Innovation and variety: The voluntary market supports a wide range of carbon reduction projects, fostering innovation and diverse environmental impact.

- Carbon neutrality goals: This market helps companies achieve carbon neutrality or even become carbon negative by providing an accessible mechanism for offsetting emissions that can't be reduced internally.

- Co-benefits: Many projects funded through the voluntary carbon market bring significant social and environmental benefits, such as job creation, community development, improved air quality, and biodiversity conservation.

- Easier entry for smaller entities: The voluntary market offers a pathway for smaller companies and individuals to participate and benefit from carbon reduction without the legal complexity of compliance markets.

- Future ready: By participating in voluntary markets, companies can prepare for potential future regulations, reducing the shock of sudden compliance costs when regulations tighten.

- Scalability and global reach: Voluntary markets connect international buyers and sellers, enabling support for global projects that reduce emissions and contribute to the global effort against environmental instability.

Members of the local community working in a tree nursery in Africa. AI generated picture.

Members of the local community working in a tree nursery in Africa. AI generated picture.

Comparing compliance and voluntary carbon markets

While both compliance and voluntary markets aim to reduce emissions, there are key differences between the two:

- Regulation: Compliance markets are government-regulated, while voluntary markets allow corporations and individuals to participate without legal mandates.

- Scope: Compliance markets typically cover large sectors like power generation, while voluntary markets often focus on project-based offsets like reforestation.

- Participants: Compliance markets involve companies required by law to reduce emissions, while voluntary markets attract those seeking to enhance their ESG commitments.

The benefits of compliance markets include enforceable carbon regulations and large-scale reductions, while voluntary markets offer flexibility and the opportunity for corporations to lead in sustainability initiatives.

The role of Article 6 of the Paris Agreement in carbon markets

Article 6 of the Paris Agreement establishes a framework for international cooperation on carbon markets. It allows countries to trade emissions reductions, helping to achieve global emissions targets more efficiently.

This promotes international cooperation by enabling countries with fewer resources to meet their goals through carbon trading while encouraging investment in carbon reduction projects worldwide. Real-world examples include countries like Switzerland working with developing nations to meet their emissions targets through carbon market mechanisms.

Discover more: What’s a green investment strategy? The $13 trillion market opportunity

How carbon credits support sustainability goals

Carbon credits represent a tangible way for organizations to contribute to global emissions reductions. They are generated by projects that either reduce or remove carbon emissions, such as reforestation, energy efficiency programs, sustainable agriculture, or biodiversity preservation. These projects help to accomplish Sustainable Development Goals like: zero hunger, good health and wellbeing, gender equality, clean water, affordable and clean energy, decent work and economic growth, sustainable cities, responsible consumption, life on land, life below water, and climate action.

Sunset over the Amazon rainforest landscape. AI generated picture.

Sunset over the Amazon rainforest landscape. AI generated picture.

The importance of verified credits cannot be overstated, as these ensure that emissions reductions are real, additional, and permanent. By addressing these SDGs, carbon credits not only help reduce global emissions but also foster broad-based development and environmental sustainability. They link economic growth with ecological preservation, making them an essential tool for achieving a more sustainable and equitable future.

Discover more: Driving revenue through sustainability initiatives

Why carbon markets matter for investors

The growing demand for carbon credits has created significant economic opportunities. With the compliance carbon market projected to hit $321 billion before 2032 and the voluntary carbon market projected to reach $50 billion by 2030, according to McKinsey, investors are looking to capitalize on the rising prices of carbon credits.

Investing in carbon markets offers dual benefits: financial returns and contributions to global sustainability efforts. As more companies commit to net-zero targets, the demand for high-quality carbon credits is expected to surge, making carbon markets a lucrative option for forward-thinking investors.

Discover more: How investors can navigate a volatile stock market

VanderStyn: ethical investment in carbon projects

VanderStyn offers investors an opportunity to engage in the expanding carbon market through its Green Carbon Fund. This exclusive fund provides access to high-value carbon projects, typically available only to major corporations.

VanderStyn’s portfolio includes projects such as reforestation, afforestation, and the distribution of energy-efficient cookstoves. All projects are verified by recognized certification bodies, ensuring that these green investments yield genuine environmental and financial returns.

Close-up of a nursery worker holding a tree seedling. AI generated picture.

Close-up of a nursery worker holding a tree seedling. AI generated picture.

Carbon markets are the future of sustainable investment

In summary, carbon markets offer a compelling opportunity for investors to achieve financial growth while contributing to global emissions reductions. As government policies, consumer demand, and corporate commitments continue to drive demand for carbon credits, the market will only expand.

By partnering with ethical investment platforms like VanderStyn, investors can take advantage of this growing market, making a positive sustainable impact on the environment while earning strong financial returns.

Table of contents

Check out our latest articles

Why is land restoration important?

Is investing in land a good idea?

10 Benefits of early stage investment strategies

Get started

Have a question or need assistance? Reach out to the VanderStyn team, and we’ll be happy to help with any inquiries or support you need