Your guide to carbon credit investment

VanderStyn leads the charge in the financial sector's sustainability revolution. As the voluntary carbon market is projected to grow exponentially, reaching $50 billion by 2030, it creates attractive opportunities for investors. Download our guide to discover how you can capitalize on this growing market.

Get your "Guide to Carbon Credit Investing" in your mailbox

With the global carbon credit market projected to grow at a remarkable CAGR of 39.4% between 2025 and 2030, the question is — can you afford to overlook this opportunity?

A high-growth market you don't want to miss

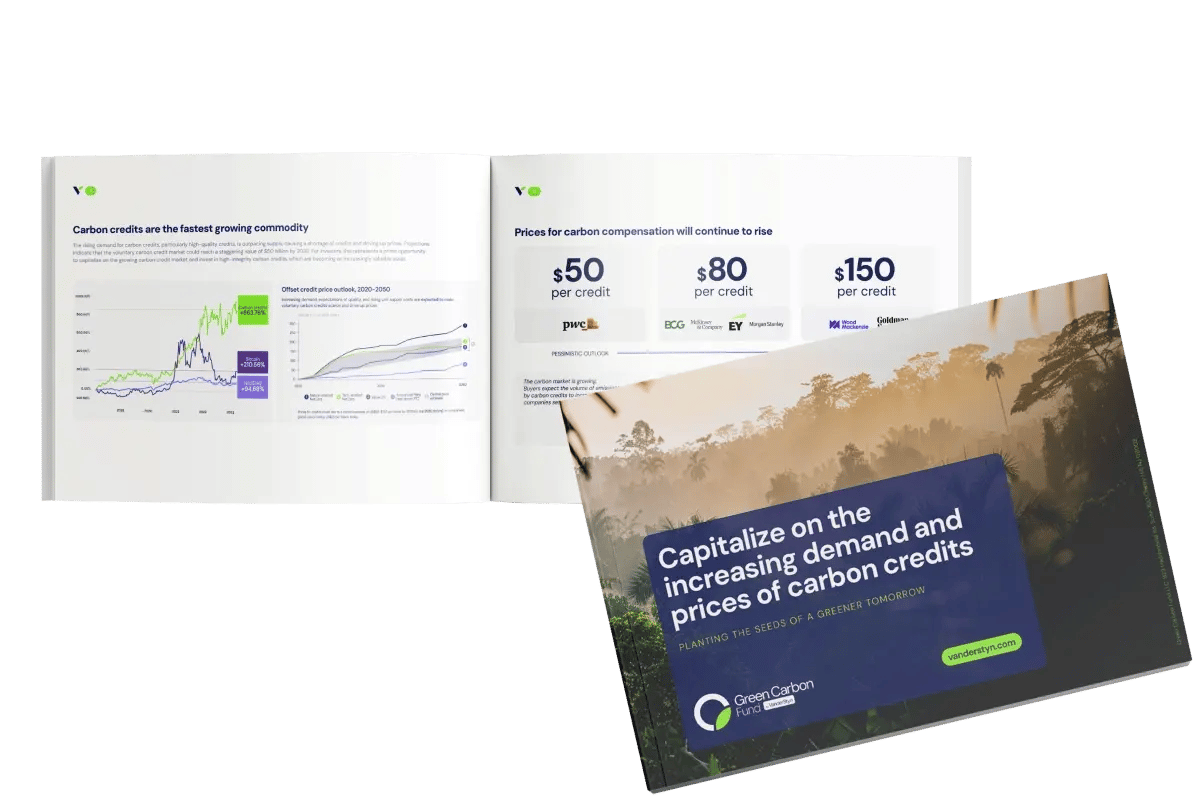

As demand for high-quality carbon credits surges past supply, prices are climbing fast. The voluntary carbon market alone, valued at $4.7 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 34.6% through 2030.

Globally, the carbon credit market is expected to skyrocket from $695 billion in 2025 to over $4 trillion by 2030 at a CAGR of 39.4%. For investors, this marks an opportunity to tap into a rapidly appreciating asset class.

.webp?width=1200&height=800&name=the%20green%20carbon%20fund%20brochure_a%20high-growth%20market%20you%20dont%20want%20to%20miss%20(1).webp)

Carbon credits are rising — But not everyone can join in

Despite the rapid growth of the carbon credit market, access remains limited for everyday investors. The space is largely dominated by corporations executing bulk transactions and benefiting from early access to high-quality projects. Regulatory complexity, high entry costs, and restrictions from major registries make it difficult for individuals to participate directly. As a result, private investors often face significant barriers to entry, both in terms of capital and market access.

Introducing: VanderStyn's Green Carbon Fund

The Green Carbon Fund opens the door for accredited investors to enter the high-potential carbon credit market, typically dominated by major corporations.

With a diversified portfolio of global nature-based carbon projects, the Fund minimizes risk while offering attractive, stable returns — up to 22.5% IRR annually and an 11.25% annual cash flow, paid quarterly. This is a forward-looking investment opportunity that aligns financial performance with a positive environmental impact.

.webp?width=1820&height=1600&name=the%20green%20carbon%20fund%20brochure_introducing_%20vanderstyns%20green%20carbon%20fund%20%20(1).webp)

Key investment highlights

+22.5%

TARGETED ANNUAL RETURN

+11.25%

ANNUAL CASH FLOW PAID QUARTERLY

$25M

CAPITAL TARGET

7 years

FUND LIFETIME

100

MAXIMUM INVESTORS

$100,000

MINIMUM INVESTMENT

Discover the strengths of the Green Carbon Fund

The Green Carbon Fund invests in carefully selected carbon projects before credits are issued, positioning investors to benefit from future value appreciation. By diversifying across various project types, stages, and global locations, the Fund spreads risk and minimizes exposure to market volatility.

This strategic diversity ensures stable, long-term performance, rather than reliance on a single project or region. As global demand for carbon credits rises — fueled by net-zero commitments — the Fund is designed to grow dynamically. Want to learn more? Download our brochure to explore how it works and how you can benefit.

What will you find inside?

- Information on the growing market

- Rising carbon pricing details

- Why invest in carbon credits

- Potential investment scenarios

- Our investment strategy

- Our path to revenue

- The Green Carbon Fund offering

Our unique investment strategy

Exclusive market access

By lowering entry barriers, we allow everyday investors to participate in a historically inaccessible market.

Expert management

Our team consists of environmental specialists who conduct rigorous due diligence on every project, ensuring high impact and integrity.

High-quality asset growth

We focus on validated projects that generate marketable carbon credits meeting current and future regulatory standards.

Risk mitigation

Through diversification and strategic early-stage investments, we reduce risks and stabilize returns.

Financial returns with positive impact

Invest in projects that not only yield potential financial gains but also benefit the planet and local communities.

Transparent and ethical investing

We offer clear communication regarding where and how investments are made, the status of projects, and the expected and realized returns.

Backed by leading certifications

Align your investment portfolio with a sustainable future while capitalizing on the booming potential of the carbon credit market.

Ready to explore this opportunity?

Unlock valuable insights about the Green Carbon Fund, its investment prospects, and how you can benefit from the rising demand and prices of carbon credits.

Want to hear more? Get in touch today.